Introduction

In the dynamic world of financial markets, traders continually seek tools that can enhance efficiency and accuracy. Automatic Trading Signals offers a suite of automated trading systems and indicators tailored for platforms like NinjaTrader® and TradeStation®. This article explores the features, benefits, and user experiences associated with Automatic Trading Signals’ offerings.

Key Offerings

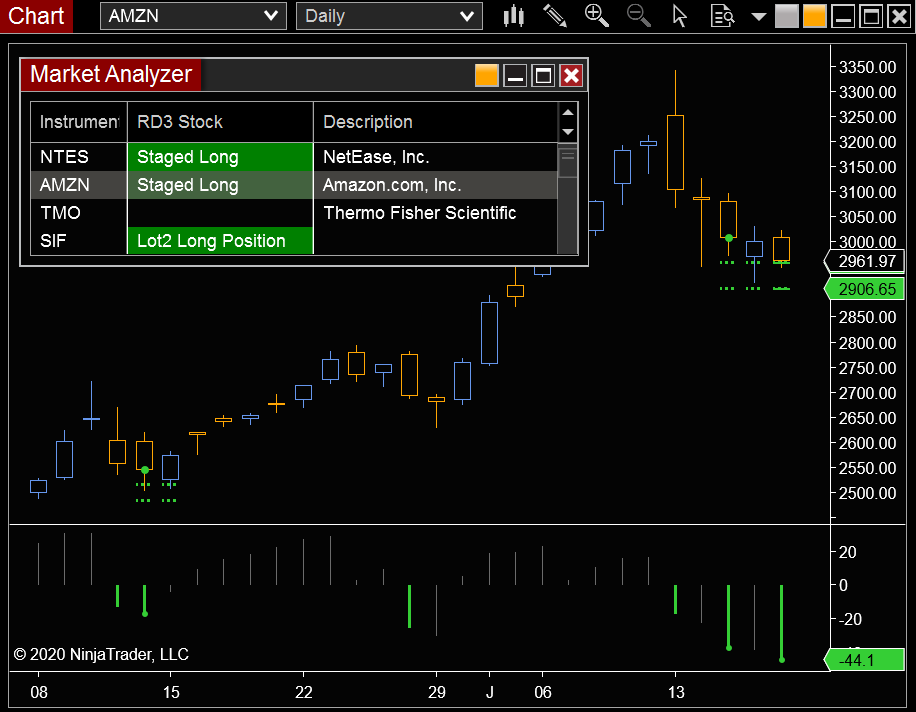

- Automated Trading Systems: Automatic Trading Signals provides fully automated trading systems designed to operate across various markets, including futures, stocks, and cryptocurrencies. These systems aim to execute trades based on predefined strategies, reducing the need for manual intervention.

- Indicators and Strategies: The platform offers a range of indicators and strategies compatible with NinjaTrader® and TradeStation®, assisting traders in making informed decisions through technical analysis.

User Experiences

User feedback on Automatic Trading Signals varies:

- Positive Feedback: Some users appreciate the platform’s automation capabilities, noting that it effectively reduces the emotional aspect of trading and allows for the execution of predefined strategies without manual intervention.

- Critical Feedback: Conversely, some users have expressed concerns about the performance of certain trading systems. For instance, a user reported that the VX9 Night and Day Trading System did not yield the expected results during their testing period, suggesting potential overfitting issues.

Pros and Cons

Pros:

- Platform Compatibility: The systems and indicators are designed for seamless integration with popular trading platforms like NinjaTrader® and TradeStation®, providing flexibility for users.

- Diverse Product Range: With offerings ranging from automated systems to individual indicators, traders can select tools that align with their specific strategies and preferences.

Cons:

- Performance Variability: Some users have reported discrepancies between backtested results and live trading performance, indicating that certain systems may not perform as expected in real-market conditions.

- Cost Considerations: The pricing of some systems, such as the VX9 Night and Day Trading System, may be a consideration for individual traders.

Conclusion

Automatic Trading Signals offers a variety of automated trading tools and indicators aimed at enhancing trading efficiency for users of NinjaTrader® and TradeStation®. While the platform provides advanced features that can cater to various trading styles, potential users should exercise due diligence. The mixed user reviews highlight the importance of thoroughly assessing the suitability and performance of these tools in line with individual trading objectives and risk tolerance.

For a visual overview and further insights into trading alerts and their effectiveness, consider watching the following video: